Financial planning for every facet of your life.

One membership that gives you all-access to an expert financial advisor who can help you with everything money touches.

Featured in

Maximize your financial outcomes with Facet.

Unbiased, personalized, and affordable financial advice for every facet of life is essential to living well. That’s why Facet covers everything money touches – like buying a home, having a baby, planning for retirement and so much more.

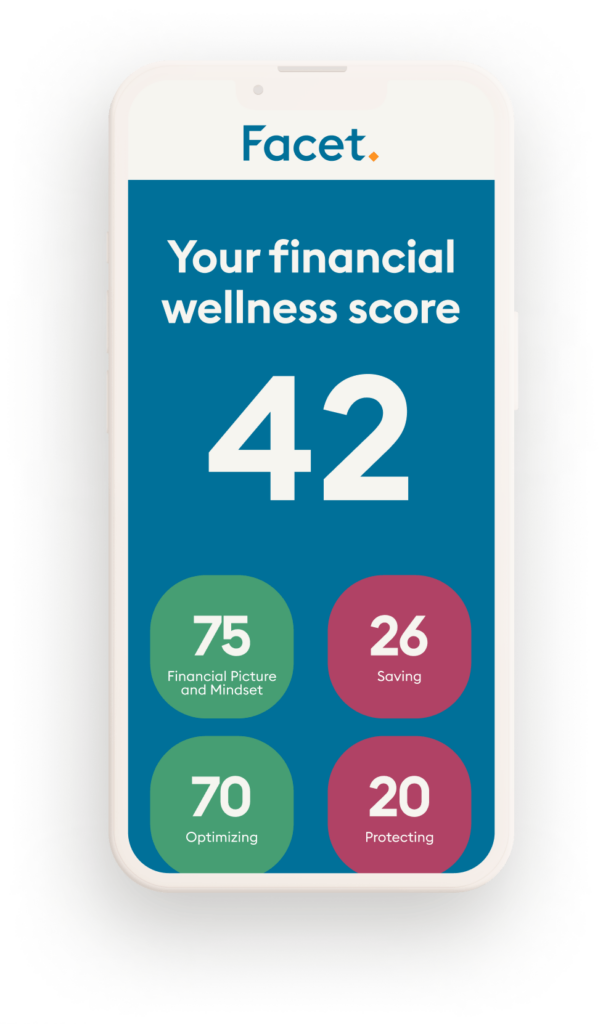

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your free financial wellness score will unlock insights into what you’re doing right and what could still be better.

Find your financial calm.

Built for everything money touches – family, career, investments, retirement and everything in between.

Get unbiased financial advice from a CERTIFIED FINANCIAL PLANNER® professional and expert team.

Experience a flat fee membership — no product sales, commissions, or surprises.

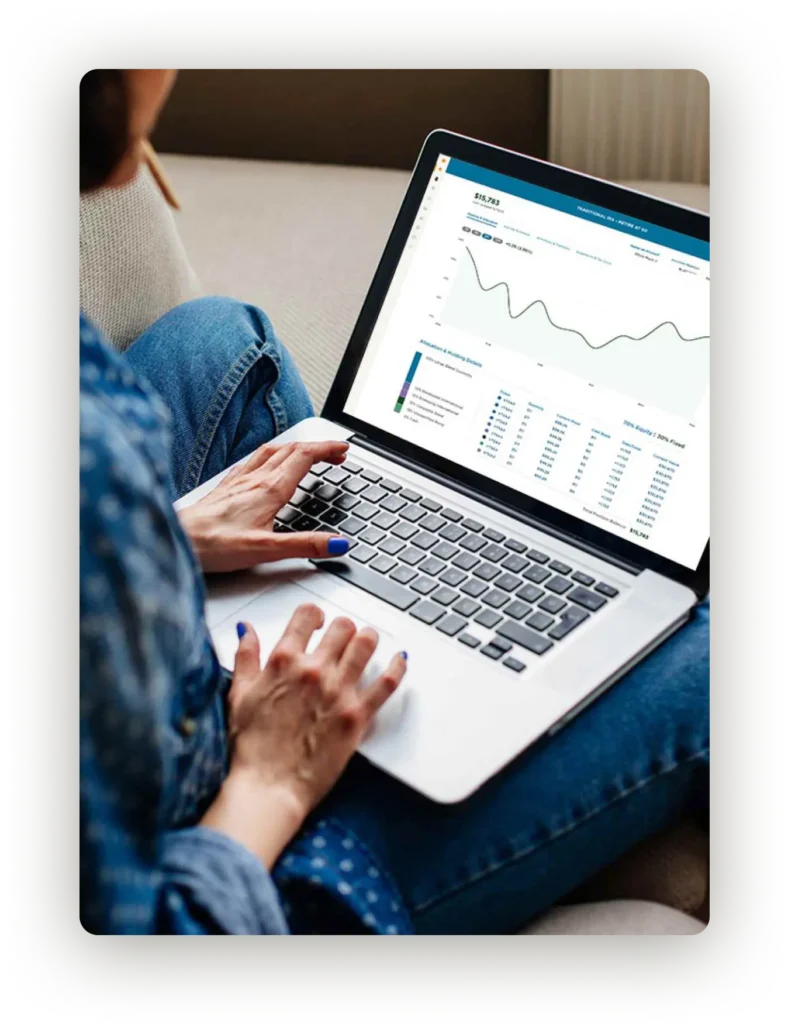

Personalized financial planning powered by technology.

At Facet, our technology is at the heart of your membership experience. You have up-to-date access to your financial data and direct access to financial experts across investments, taxes, benefits, and more.

Facet is a community.

Check out why our members and thought leaders choose Facet.

Testimonials were provided by current clients of Facet Wealth, Inc. (“Facet”). Clients have not been paid for their testimonial and there are no material conflicts of interest that would affect the given testimonials. Endorsements were provided by promoters or influencers who were not clients of Facet when initially engaged. Individuals were compensated by Facet , which may have included free or discounted planning services. Endorsements and testimonials may not be representative of the experiences of other clients, and do not provide a guarantee of future performance success or similar services.

Isha

Complete trust in planner = peace of mind

Tyler

Support + guidance to reach self-fulfillment

Antonio & Gimez

Affordable expert guidance from a CFP® professional

Brad & Cat

Membership fee based on need + holistic approach

Jordan & Marissa

Direct access to experts

“The combination of the tech platform that Facet provides and our planner has been great. It’s been great to be able to have a visual representation of all of our assets and our investments, and then having an individual there to ask questions if we don’t understand something.”

Antonio & Gimez

Rego Park, NY