Key takeaways

- While local housing markets may slow, both supply and demand conditions are generally supportive of maintaining housing prices

- Home purchase prices are still reasonable when compared to renting

- The kind of forced selling and foreclosures that drove home prices down in 2008 does not appear likely to repeat

- If prices do decline, it will probably be mild

- For buyers or sellers of homes in this market, focus on what is right for your life circumstances and what you can afford

Is the housing bubble bursting? Was it even a bubble in the first place? In 2021, home prices rose almost 19%, more than any calendar year during the early 2000’s housing bubble. Now with mortgage rates surging, some are wondering if home prices could start to fall, as they did in 2007-2009. For those looking to buy, that could be welcome news. For those already in a home, that may be cause for concern. Here are our thoughts on the state of the housing market and where it might go next.

Housing fundamentals are positive

Other than mortgage rates, the core fundamentals underpinning the housing market are quite strong.

The first fundamental is simple demographics. Right now the largest age group in the U.S. population is 30-34 year olds, with the second largest being 25-29 year olds. This population is in the prime years to become first-time homeowners, effectively increasing the base of demand for homes. This wasn’t the case in the 2000’s. The 25-34 year-old cohort was in decline as a percentage of the population from 2000 through 2008.

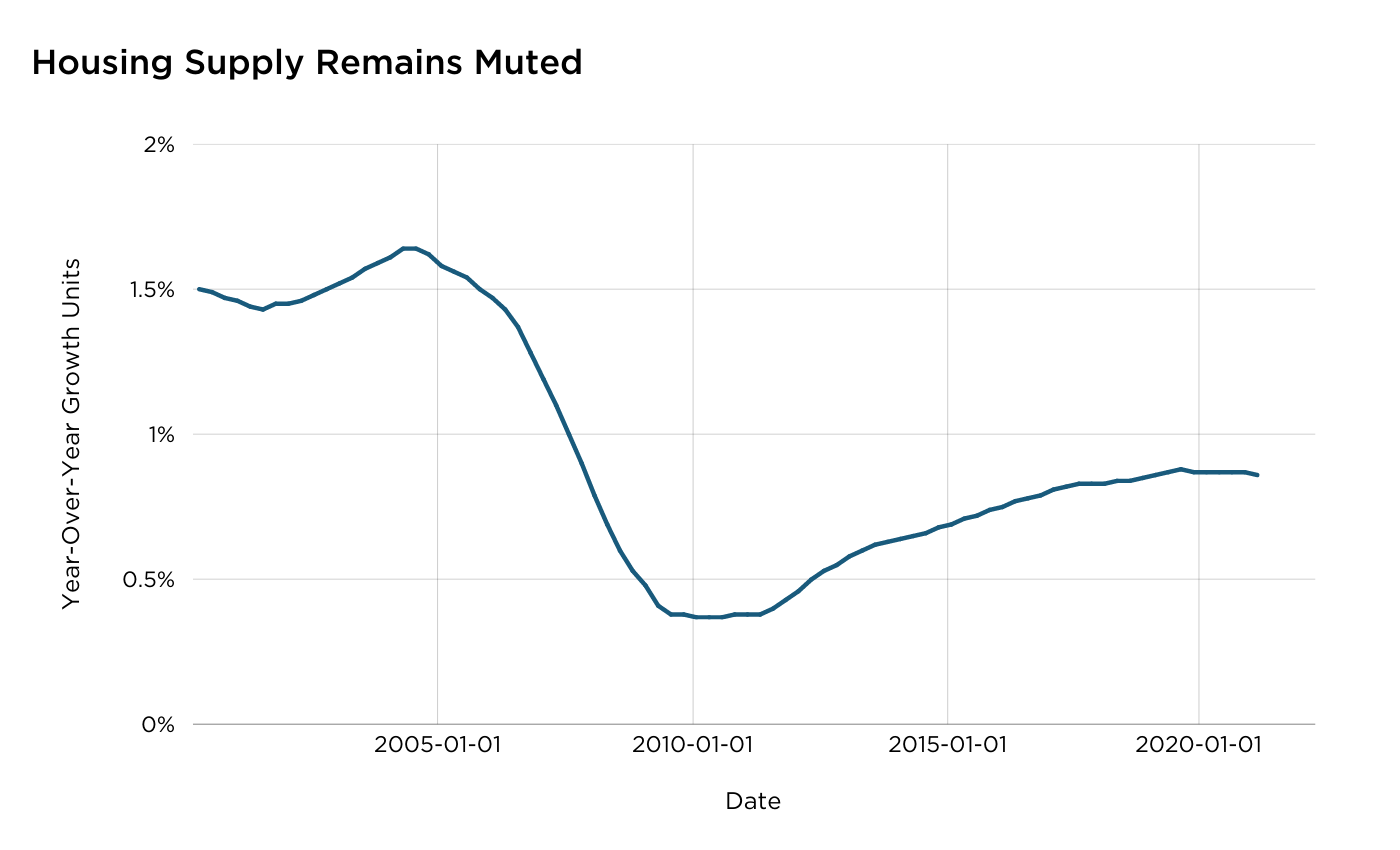

Second, there has not been a large increase of housing supply to meet the demand from these first-time homeowners. In the last two years, total housing units in the U.S. have grown by 0.87% per year. That compares with a 1.5% annual growth rate from 2003 to 2007.

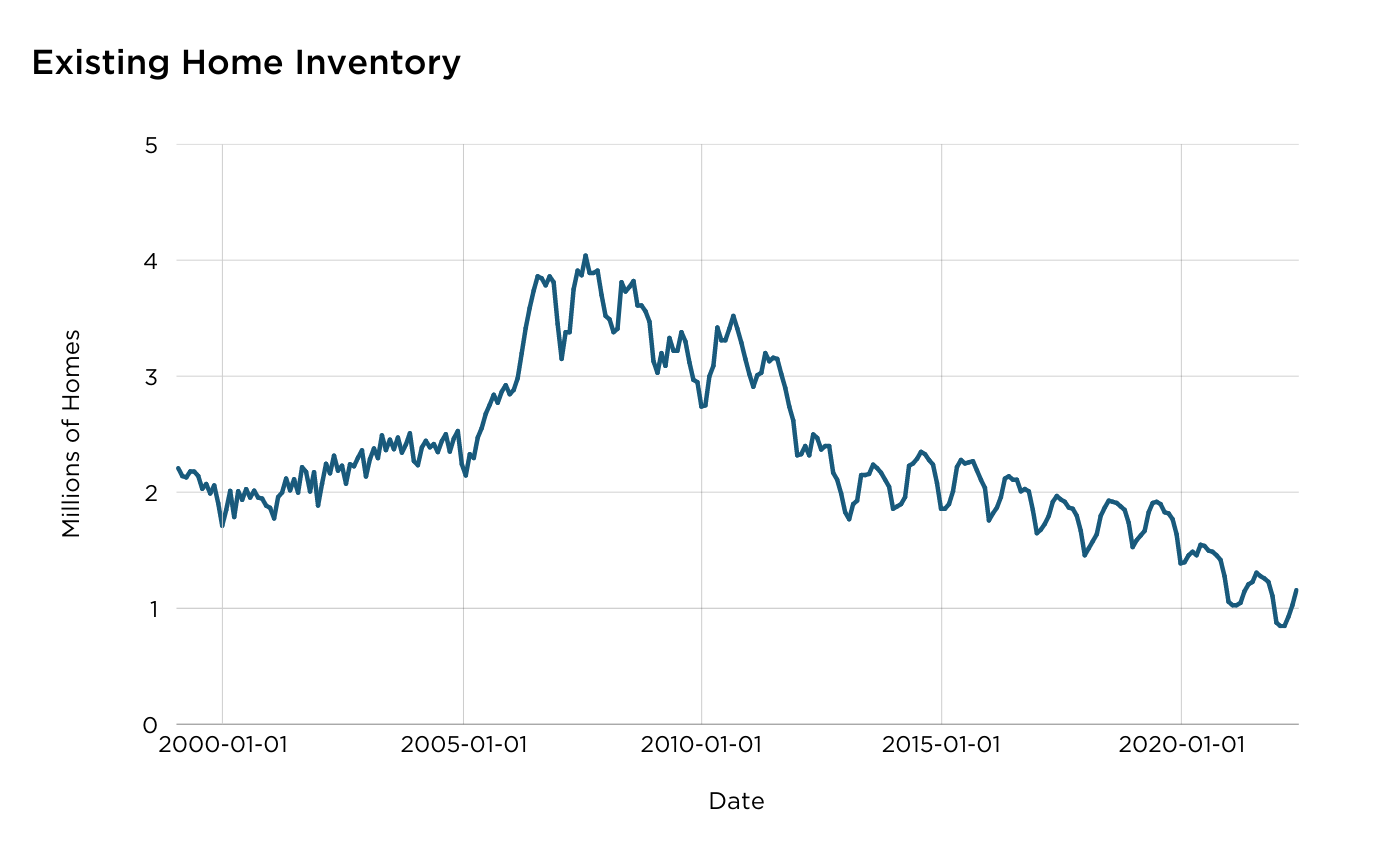

We can also see this by looking at home inventory, i.e., the number of existing homes currently for sale. This measure is still near all-time lows.

Renting is expensive, too

The surge in mortgage rates certainly makes buying a home less affordable. The national average 30-year mortgage rate has risen from 3.11% at the start of 2022 to 5.51% now. Using the U.S. median home price, that suggests that the per-month payment on the median house with the average mortgage rate has gone from $1,613 per month to $2,283 just this year, a 42% increase, and that’s before considering taxes and insurance.

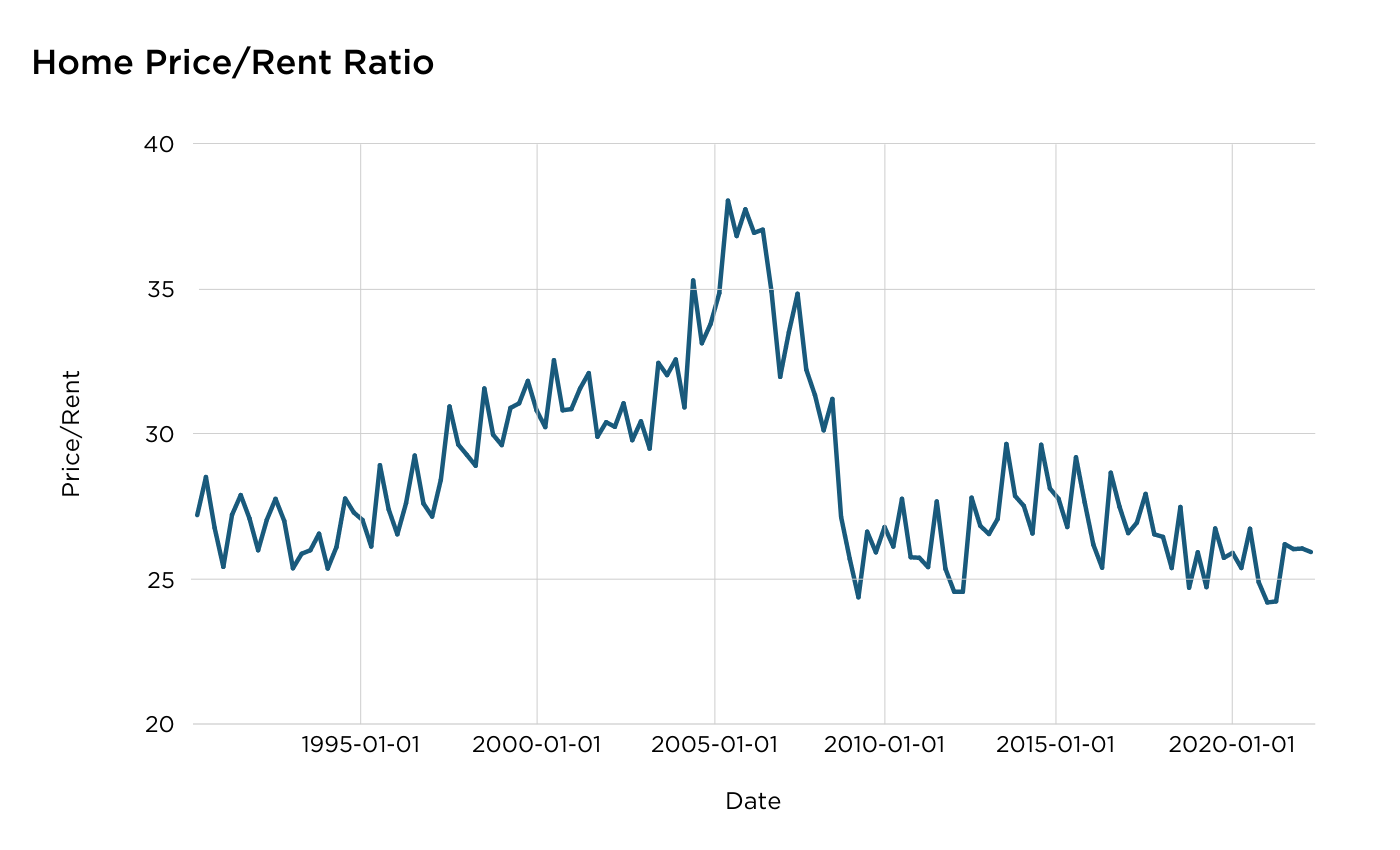

However, for better or for worse, renting isn’t necessarily a much cheaper option. The median rental rate has risen by more than 20% since 2020. In the 2000’s housing bubble, one sign that home prices were rising to unsustainable levels was a divergence in the ratio of home prices to annual rent costs. Today this ratio remains well within the normal range.

The logic behind this ratio is simple: there should be some kind of relationship between the cost of renting and the cost of home ownership, as they are substitutes for each other. Ultimately everyone has to live somewhere, and thus if rents are rising, that supports the price of homes as well.

Forced selling was a major part of the 2008 bust, unlikely to happen today

Those that lived through the 2008 housing bust remember the huge spike in home foreclosures during that time. A foreclosure is a kind of “forced sale,” or a sale that is going to happen almost no matter what the price is. Not surprisingly, having a large number of sellers willing to unload at any price puts a lot of pressure on the market. This is what turned a bad housing market into a crash.

There were two big sources of foreclosures. The first was simple: banks made too many risky loans, especially to so-called “subprime” borrowers. The percentage of mortgage loans made to borrowers with a credit score below 620 reached as high as 15% in early 2007. In the first quarter of 2022, it was only 2%.

The other source of foreclosures was so-called “strategic defaults.” In the U.S., mortgages are non-recourse, which means that the bank can take your house if you don’t pay, but can’t go after any of your other assets or income. During the 2007-2008 bust, some people wound up “underwater” on their mortgage, meaning they owed more money to the bank than the house was worth. In such a situation, one might make the decision to stop paying on your loan and just let the bank take the house.

In reality, strategic defaults were rare among people who were actually living in the house, but quite common among people who bought a house as an investment. At the time, it was popular to buy an older home, do some renovations, and then try to sell it for a profit. That worked great when home prices were rising, but when they were falling many of these investors quickly realized that not only were they not going to make a profit, they were going to wind up owing the bank money even if they sold the house. Given all that, many just chose to walk away from the renovations, sometimes with the project only half complete.

Today’s situation is quite different. Even if home prices started falling, we would expect far fewer forced sales. First, as we already mentioned, the quality of borrowers today is substantially better than the 2000’s bubble. But just as importantly, housing today is being overwhelmingly bought as a primary residence or for the purposes of renting. If you bought a house for $300,000 and the price declines by 10%, that’s a disaster if you wanted to flip the house in a couple of months. If you were planning on living in the house for several years, and if you can still afford the mortgage, why would you realize the $30,000 loss by selling the house? You wouldn't.

It is similar for houses bought for rental. If the property was bought with a fixed rate mortgage, and with rents generally rising, the property is just as profitable as before. There is no reason for these kinds of investors to sell the property into a down market.

Will prices fall? That depends…

We are already seeing signs that housing activity is slowing, including a drop in mortgage applications, some decline in existing home unit sales, and anecdotes of price reductions. We think it is safe to say that demand for homes will be impacted by mortgage rates, while supply of homes will probably decline too as sellers become unwilling to sell at a loss. So the easiest prediction is that activity (i.e., buying and selling) in the housing market will slow.

So will there be a generalized decline in home prices? We think that depends a little on how you define it. A house for sale today will probably take longer to sell than it would have six months ago, and may very well sell for a somewhat lower price. Stories of bidding wars and houses selling over asking price may become a thing of the past. If you aggressively watch your house’s hypothetical value on Zillow or Redfin, there’s a good chance that value will fall from its peak at some point.

Real estate is also a very localized market. There are many factors that influence where people choose to live, from proximity to family, commute time, amenities, weather, cost of living, etc. The amount of new construction is also quite variable from place to place. So while certain factors impact housing nationwide, like mortgage rates, a lot of factors are quite specific to a particular place. We can see this just by looking at last year’s price changes: Washington D.C. and Minneapolis, MN saw home prices rise by about 12%. San Diego, CA was about 28%. Tampa, FL was 36%. It might be that the places that have run up the most are more vulnerable. Or, it could be that the reasons why people have wanted to move to San Diego or Tampa continue to keep demand strong in those places.

A substantial nation-wide sell-off, like the one in 2007-2009, is much harder to imagine. The key factors that led to the huge bust in 2008 just aren’t present today. So while we can’t know the future, we think a mild decline is more likely than a major correction.

What to do if you are in the market

So what does all this mean if you are actually trying to either buy or sell a home? First and foremost, surrounding yourself with the right team of professionals can make all the difference in getting to the best outcome. Make sure you have a mortgage loan office, a licensed REALTORⓇ, and a CERTIFIED FINANCIAL PROFESSIONAL to help you navigate one of the largest financial decisions you may ever make.

For prospective home buyers, perhaps a somewhat slower market will be a stress reducer. Even if prices don’t decline much, you might find yourself with more negotiating power, as well as more time to make your decision. Otherwise, our recommendations when thinking about a home purchase haven’t changed: understand how it will affect your financial plan today and in the future; make sure you can afford your monthly payment at today’s mortgage rate; be patient and make a smart, informed decision; and avoid making the biggest mistakes that many homebuyers make.

If you are a seller of a home, don’t become anchored on the peak price you saw on Zillow at some point. Even if prices were to reverse all of the gains of the last year, the national average home price would still be up 23% since 2019. That’s not bad! If your personal circumstances are such that now is the time to sell, your timing might not be perfect, but it is still pretty darn good.