Key takeaways

- A recession is not a guaranteed outcome right now

- If one does happen, it might be relatively mild

- A substantial economic slowdown is already reflected in current stock prices

- Uncertainty is weighing on the markets, so it might not take much for a rally

The Federal Reserve’s battle against inflation is still in its early stages, but many are concerned that its policy decisions will push the economy into a recession. Recessions make most of us nervous, because they can lead to job losses and an accompanying decline in financial markets. While we certainly acknowledge the possibility of a recession, we think the discussion requires more nuance than simply asking the question, “Will there be a recession — yes or no?”

Why worry?

Inflation happens when total spending (demand) overwhelms the economy’s ability to produce goods and services (supply). The Fed can only influence one of those two factors: demand. Changing interest rates can’t make companies produce more goods and services (i.e., supply), but higher rates make borrowing more expensive, which tends to slow overall spending (i.e., demand). In other words, when the Fed is raising interest rates, they are trying to slow the overall pace of spending in the hopes that it brings better balance to supply and demand.

This balancing act is why the Fed has such a tricky job. It needs to reduce demand enough to curb inflation but not by so much that it causes a recession. If you hear people talk about the Fed trying to engineer a “soft landing,” this is exactly what they mean: people and companies will gradually cut their purchases, prices will drop, and inflation will ease.

The economy is starting from a strong foundation

By just about every measure, the economy is currently much stronger than it was before the COVID recession. The table below shows some key statistics comparing today to the 2014-2019 average. By all accounts, the economy is booming.

| 2014-2019 ann. avg. | Today | |

| Real GDP | 2.3% | 3.5% |

| Consumption | 4.0% | 8.5% |

| S&P 500 Earnings Per Share growth | 5.9% | 18.4% (projected) |

| Factory orders | -1.0% | 12.0% |

| Average job growth/mo. | 268,000 | 488,0001 |

12022 YTD average

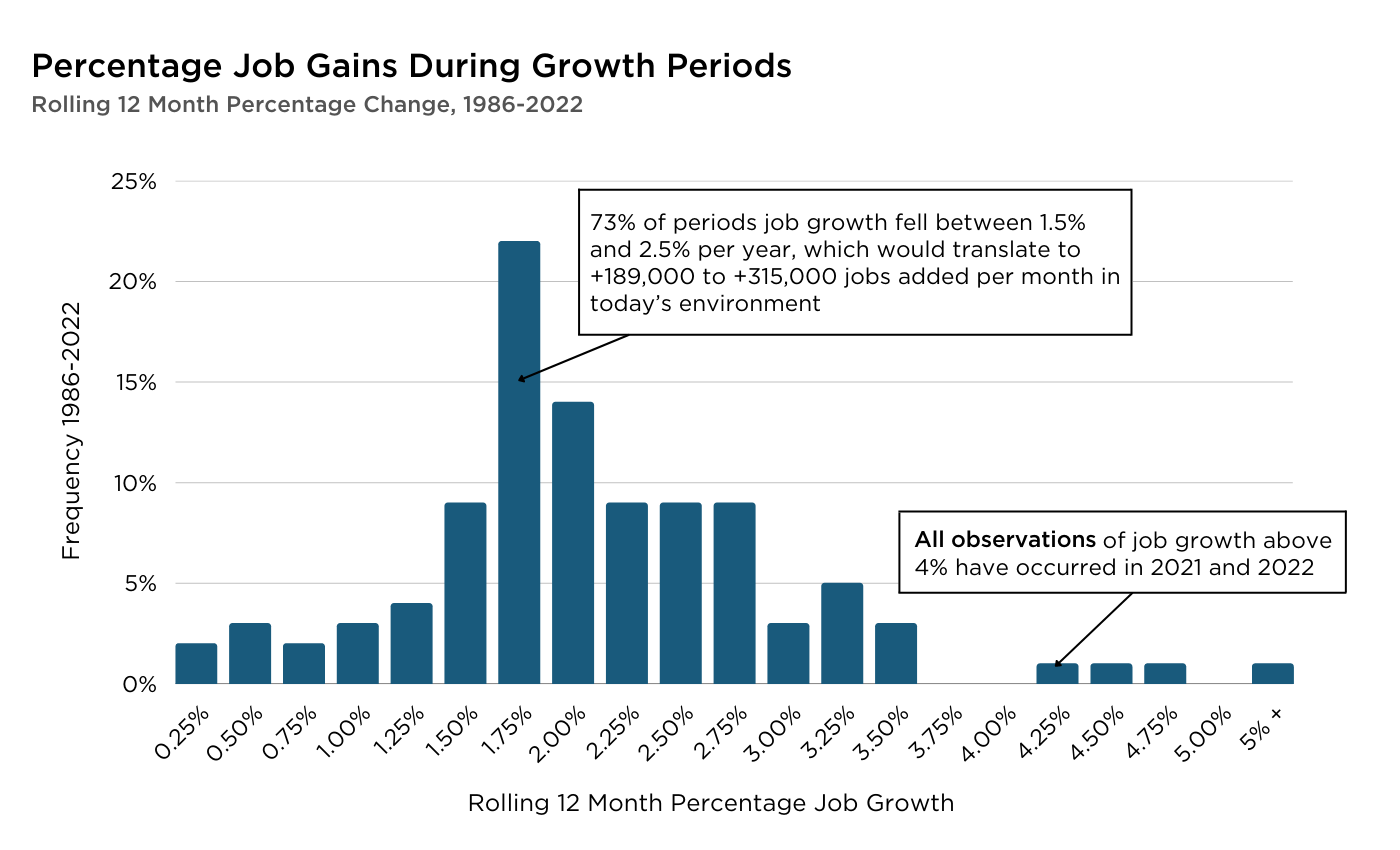

Job gains are another statistic that suggest a strong economy. The chart chart below is a histogram of percentage job gains since 1986, limited to periods where jobs were growing, which allows us to look at non-recessionary periods.

The labor market can cool without a recession

It is possible that inflation could slow without the need for layoffs. If companies feel that their current staffing is adequate, maybe by making do with fewer employees or implementing labor-saving processes, job openings will decrease. This would effectively ease the fierce competition for labor. In this scenario, unemployment doesn’t rise because companies aren’t actually laying anyone off, but wage growth might cool off, which could help bring inflation back to normal levels.

There are signs that this is beginning to happen. Recently, Amazon and Walmart announced that they hired too aggressively in the first part of the year after over-estimating employee turnover. Neither company laid off employees; they slowed the pace of new hires until natural employee attrition adjusted their workforce to the appropriate size.

This scenario is exactly what people mean when they describe a soft landing: a situation where inflation falls but the economy remains strong.

A “soft landing” is tricky

Successfully executing a soft landing is a difficult task for two major reasons. First, interest rates are a powerful, but imprecise, tool. Economists generally believe that changes in rates become more impactful once money becomes “tight.” Put another way, at some unknown level of interest rates the Fed’s policies would actually decrease demand. For example, higher rates might make borrowing money to fund large projects uneconomical for businesses. The problem is that no one knows ahead of time what level of rates constitute “tight money.” For example, the consensus is that policy will be “tight” when the Fed’s target climbs above 3%, but that same consensus was more like 2% just six months ago.

The second thing that makes a soft landing challenging to execute is that the effects of monetary policy take time to reverberate through the economy. To understand why, a great example can be seen in the construction industry. Any new buildings currently under construction were already funded at yesterday’s interest rates. The Fed can raise rates today, but all of the construction that has already been funded will continue. Raising rates has little effect on current activity, but they do affect future activity. Decisions made based on the new rates won’t be noticeable for several months.

A good analogy for a “soft landing” is to think of it like backing a car into a parking space without a rear view mirror. You will only know when you are in the space by the bump of your tires hitting the curb. The only thing you can do is try to back up gently enough that you just tap the curb. The fact that inflation is so high makes performing a soft landing a bit more difficult, because the Fed needs to move quickly. Instead of backing into the parking space at 5 miles per hour, they have to go 35 mph – which probably makes executing a perfect parking job nearly impossible.

This is why Fed Chair Jerome Powell recently pivoted to saying they hope for a “softish” landing. By this, he likely means that the Fed’s fight against inflation might result in some slowing of the economy or even a minor increase in unemployment, but that the goal is for either result to be temporary and not lead to a recession.

Past soft landings look a lot like today

The Fed has managed to perform soft landings twice before. The two occasions show very encouraging parallels to today. The first was in 1995, after the Fed completed 3% worth of rate hikes the prior year, which resulted in Gross Domestic Product (GDP) slowing from 4.1% in 1994 to under 1.5% in the first half of 1995. The Fed then chose to cut their rates by 0.75% over the course of 1995. The economy regained its footing and the expansion continued for five more years.

The year 2018 was a similar story. The Fed was targeting a 2.5% rate for the end of the year, but in the fourth quarter of that year, economic activity declined rapidly. Similar to 1995, the Fed wound up lowering rates by 0.75% in 2019. Again, economic growth reaccelerated, and had it not been for COVID in 2020, this probably would have been another example of a soft landing.

In our view, a key reason why both 1995 and 2018 wound up as soft landings was that there were no other fundamental problems with the economy, much like today. The only reason why growth was slowing was because the Fed had “over tightened” while trying to strike a balance between supply and demand; hence the Fed’s choice to cut rates by a small margin solved the problem and resumed growth.

If we do get a recession, it could be mild

We think circumstances are similar to those in 1995 and 2018. The economy is strong at its core. If not for inflation and the Fed’s fight against it, we surely wouldn’t be talking about a recession. If high interest rates or “tight money” become the only reason why growth slows, the Fed can back off rate hikes and allow the economy to continue to grow.

One major difference is that inflation wasn’t as high in 1995 or 2018 as it is today, which might mean the Fed has less flexibility. They might see the economy start to slow in the coming quarters, but choose to keep raising rates to be sure that inflation slows toward their 2% target. Such a scenario could result in a recession, but a short and mild one. In other words, a pattern similar to 1995 or 2018 but where the bottom is a bit lower.

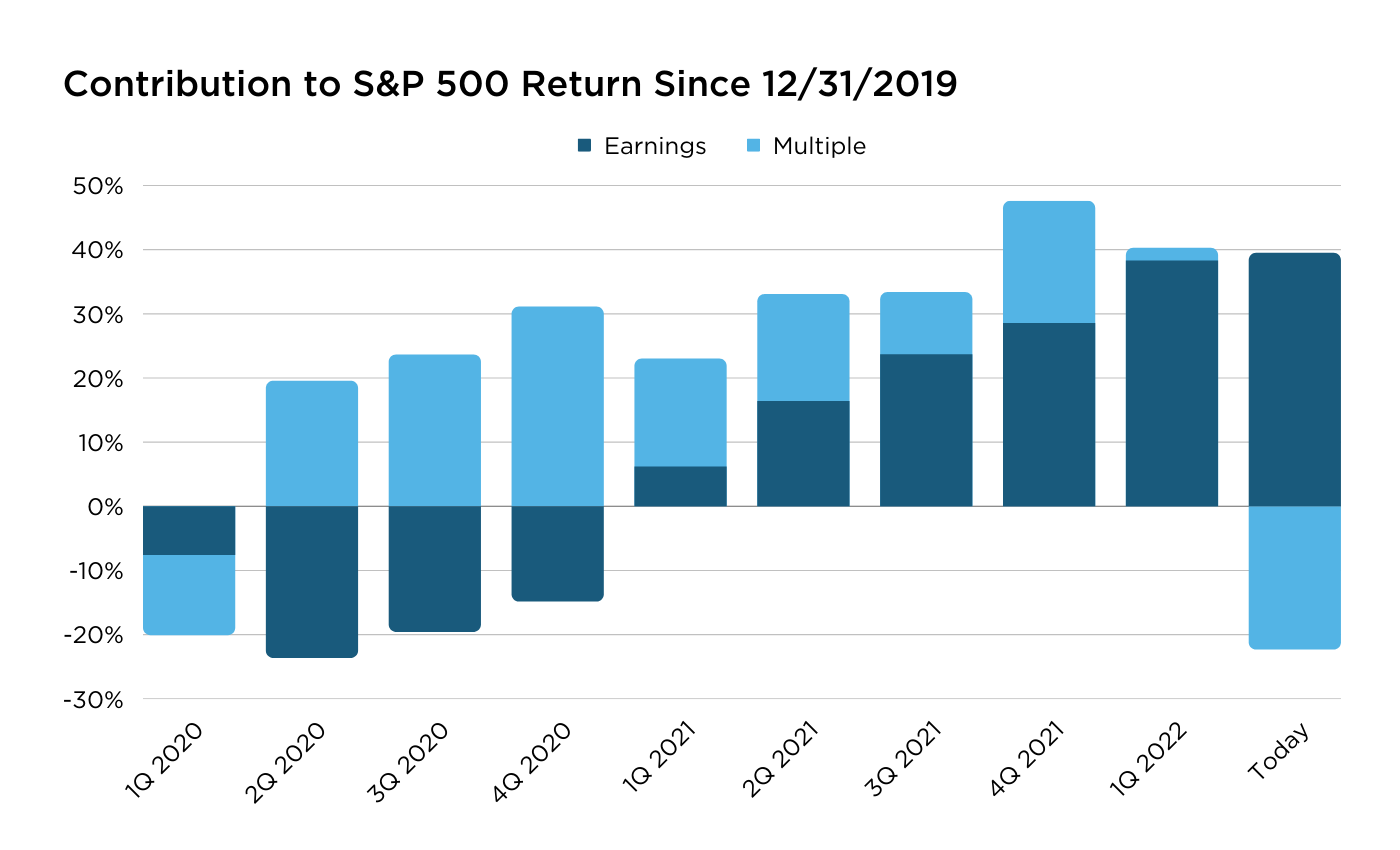

Stocks aren’t expensive anymore

We certainly acknowledge that a recession is a risk and it is true that recessions tend to be tough environments for stocks. However, let's remember that stock prices essentially reflect what markets anticipate the company’s profits will be in the future. For example, with how far stocks have already fallen in 2022, they are certainly pricing in a period of somewhat weaker earnings. One way we can see this is by looking at the so-called earnings multiple (or sometimes called the price/earnings or P/E ratio). This is just the ratio of the company’s price to its profits, but can be a good gauge of optimism about a company’s future.

The conclusion here is that earnings have made up more than 100% of stock returns since 2019 as multiples have contracted by a decent bit. This means that markets are now priced with a little cushion, and are better positioned to withstand some kind of slowdown.

The bar for a rally is probably pretty low

The Fed stepping up its battle against inflation is creating a lot of uncertainty in markets, and markets hate uncertainty. Markets often decline more than they should when investors are uncertain. Traders can price in bad news and move on, but what they can’t handle is the unknown. The silver lining is that it won’t take much for stocks to rally. Often, people assume that problems need to be “solved” for bear markets (in which stock prices are falling) to end. In this case, that would mean that inflation needs to come down to a healthy level and the economy needs to keep growing. That’s not normally the case. Usually the bottom of a bear market comes when the level of uncertainty diminishes and markets continue to rally as circumstances start to improve.

This time will likely be no different. The first step for markets to bottom will be that the high degree of uncertainty coming from the Fed diminishes. That would probably occur because investors become a bit more confident that inflation is getting under control. We don’t know exactly when this sequence will start. Maybe it already has started, or maybe there are more stock market declines in store. Regardless, this helps to show that it doesn’t take much for stocks to rally again.

Things might not be that bad after all

When markets are falling, it can be very easy to grow pessimistic. After all, markets wouldn’t be falling unless there was something bad happening, right? While it may not seem obvious, it is very important to stay invested in the market in these situations. Timing entries and exits into stocks is always difficult and is made more difficult by the high volatility that accompanies bear markets. Despite the general air of negativity, there are plenty of scenarios where the economic outcome isn’t so bad. If any of those come to fruition, stocks are probably going to rise, possibly in a big way. Even if there is a recession coming, there will eventually be a rebound, and that rebound may be triggered by what seem like minor events. When that happens, you will want to be fully invested.

When deciding on tailored portfolios in relation to the overarching planning process, we factor in the assumption that there will be large drawdowns from time to time. What has happened so far in 2022 is well within the bounds of a typical market correction, which are factored into our planning strategies. What isn’t built into our planning process is suffering through this downturn and not catching the rebound. Staying in the market over time is the best way to meet your investment goals.