Key takeaways

- Scams can come via phone, text, or email

- Often, scammers pose as government officials or major technology firms

- Never give personal info such as Medicare or Social Security numbers to someone unknown

- Scams often increase after natural disasters, with scammers posing as charities, government agencies, or contractors

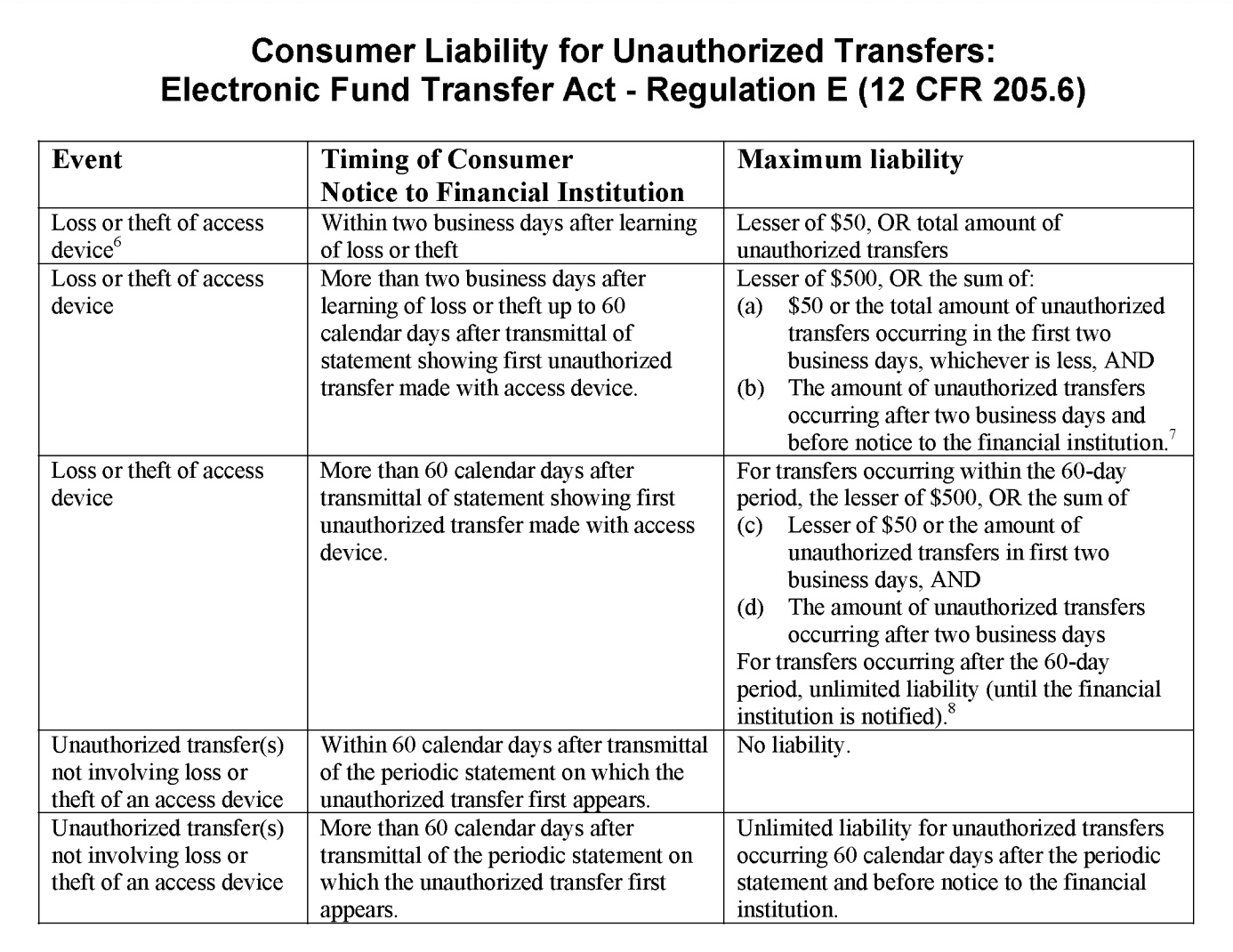

- When the scam involves money transfers, Regulation E can offer protection

A threatening call from the IRS. A surprise notification about winning a contest. A grandchild stranded in a foreign country begging for money.

Whether by email, text, or phone call, scammers often target older individuals who may be more likely to fall victim to being swindled.

An estimated 59 million Americans lost money to scammers in 2021, and the average loss was $1,200.

You can’t monitor every minute of your parents’ day. But you can educate yourself, and your parents, about common scams and how to protect against them.

How most scams work

There are four basic types of phone scams:

- Unsolicited calls from someone claiming to work for a government agency, public utility, or major tech firm, such as Microsoft or Apple. Most of these will never actually call people unsolicited; virtually all government agencies and public utilities use written notices, not phone calls.

- Unsolicited calls from charity fundraisers, especially during the holidays and after disasters. These may or may not come from a charity that you or your parent has donated to previously.

- Calls pitching products or services with terms that sound too good to be true. These may include:

- product trials

- cash prizes

- cheap travel packages

- medical devices

- pre-approved loans

- debt reduction

- low-risk, high-return investments

- winning a contest you don’t remember entering

- An automated sales call from a company you have not authorized to contact you. That’s an illegal robocall and almost certainly a scam.

Not all scams start with a phone call. For example, a text, email, or Facebook message congratulating you on winning a contest and asking for a “processing fee,” is a scam 99% of the time.

One other common scam involves overpaying.

For example, a scammer agrees to buy an item listed for sale and “accidentally” sends a check for too much money. Then the scammer requests a refund of the excess amount via a money-transfer app.

The victim unwittingly deposits the check and then “refunds” the buyer. The scammer is long gone when the check bounces a few days later.

There are other red flags that consumers should know about, too.

Other red flags to look for

If a caller or email sender insists on being paid via gift cards, wire transfers, or cryptocurrency, that’s usually a scam. (Scammers love payments that can’t be traced or reversed.) This includes customer support for computer or internet connections.

If someone claiming to be from a government agency asks to “confirm” information the agency would already have, such as a Social Security or Medicare number, that’s a scam.

Government agencies don’t typically reach out via social media. Any “notification” that doesn’t come through the mail is almost certainly a scam.

Unscrupulous contractors are particularly fond of this scam: the contractor will knock on the door, offering to seal a driveway or perform some other service for a low price because they “have leftover material” from a job they just did for a neighbor. They’ll spray a coating onto the driveway, collect their money, and be long gone when the next rain washes the “coating” away.

Scams are especially likely following a natural disaster. Fake charities and repair companies prey on people, especially senior citizens, in the wake of the chaos caused by a natural disaster.

Regardless of the type of scam, there are several smart, easy ways to protect a parent (or yourself) from scammers.

Scam protection

In general, always be suspicious when something seems too good to be true.

When in doubt, hang up the phone or close your browser before making a move.

Here are some tips to follow:

- Put all phone numbers on the FTC’s Do Not Call Registry or call 888-382-1222 to register phone numbers or report illegal robocalls. Keep in mind that automated calls are permitted for some informational or non-commercial purposes, such as calls from political campaigns, companies with whom the recipient already has a business relationship, and nonprofit groups such as AARP.

- Install a call-blocking mobile app or device to screen calls and weed out spam and scams, such as NoMoRobo. Some telecom providers offer blocking tools as well.

- Never, ever install software at the request of a random caller. This includes mobile / iPad apps, support software for computer, or software “updates”.

- Don’t answer calls from unfamiliar numbers that match the first six numbers of your phone (or your parent’s phone). Scammers use technology to “spoof” a number that appears to be local.

- Hang up on robocalls.

- Don’t return one-ring calls. These may be scams connected to hotlines in African and Caribbean countries that have U.S.-style three-digit area codes. Returning those calls can result in hefty connection and per-minute fees.

- Don’t ever give out personal info, such as Social Security numbers or credit card info, to an unknown person or entity.

- Don’t click on the link from an email that claims to be from an official entity; look up that entity and use that contact info instead.

- Don’t ever pay registration, processing fees, or other charges to get a prize or a supposed free product.

- Don’t make payments by gift card, prepaid debit card, or wire transfer.

Still, even with due diligence, scams can happen. If the scam involved a money transfer, there might be a recovery option most people don’t know about.

A little-known solution: Regulation E

Peer-to-peer money transfer systems such as Paypal, Venmo, and Zelle all have disclaimers that transactions cannot be reversed. So if a parent (or anyone) makes a mistake when sending money, or accidentally sends money to a scammer, that money is gone forever, and there’s no recourse, right?

Wrong.

This may seem like a clickbait headline, “Things your bank doesn’t want you to know,” but it turns out that money transfer systems can’t walk away from responsibility or liability, even if they tell you upfront that all money transfers are permanent.

The secret is a little-known clause in the Electronic Fund Transfer Act (EFTA), called Regulation E.

Chances are your bank or credit union has never mentioned it. Still, Regulation E protects consumers when they transfer funds electronically: it allows you to dispute an ATM withdrawal, debit card purchase, or electronic funds transfer.

The law requires that after you notify your financial institution of an error involving an electronic funds transfer, such as sending money to the wrong person, the financial institution must:

- Promptly investigate the oral or written allegation of error.

- Complete its investigation within 10 business days.

- Report the results of its investigation within three business days after completing its investigation.

- Correct the error within one business day after determining that an error has occurred.

Regulation E defines “errors” as:

- An unauthorized electronic fund transfer.

- An incorrect electronic fund transfer to or from your account.

- The omission of an electronic fund transfer from a periodic statement.

- The financial institution makes a computational or bookkeeping error relating to an electronic fund transfer.

- Your receipt of an incorrect amount of money from an ATM.

In this case, errors would include fraud, aka unauthorized electronic fund transfers, defined as any transfer from an account initiated by someone without authority to initiate the transfer and from which you receive no benefit. Surprisingly, they can also involve authorized transfers, depending on how a financial institution deems the transaction.

The law also sets liability limits of $50 per transaction if consumers meet the reporting deadlines.

Source: Elliott.org

Final word

Protecting yourself or your parents from scams starts with knowing the laws and best practices for avoiding and recovering from financial scams.

A CFP® professional from Facet can help build and manage a plan that mitigates many risks while helping you, your parents, or anyone working directly with a professional to make the financial decisions that will help you all live the lives you want to enjoy—today and tomorrow.