Key takeaways

- The Federal Reserve is hiking interest rates more aggressively to combat inflation and is likely to continue doing so in the coming months

- Inflation is running at levels not seen in 40 years, brought on by a booming economy and a very tight jobs market

- Part of the Federal Reserve’s job is to keep inflation low but they have fallen a bit behind the curve. They are now moving more quickly in an attempt to slow demand and bring inflation down

- Inflation and the Fed have contributed to heightened volatility in markets so far this year and this is likely to continue going forward

- Higher interest rates can affect how you save for short-term goals, your ability to make major purchases, and your long-term investing strategy

TABLE OF CONTENTS

On Wednesday, May 4, the Federal Reserve (the Fed) took the unusual step of raising interest rates by 50 basis points or 0.5%. Normally, when the Fed is hiking interest rates (also called “tightening policy”), they move in exactly 0.25% steps. In fact, this move breaks a streak of 26 rate hikes of exactly 0.25%. The last time they hiked by more than 0.25% at once was May of 2000.

Why is the Fed resorting to such an unusual move? The easy answer is inflation. The more pointed answer is that the Fed now knows they’ve fallen behind the curve. With inflation currently running at a 40-year high and it being much higher than they thought possible only a few months ago, the Fed has some catching up to do.

Inflation, the Fed, and interest rates have contributed to financial market volatility for the last several months, and may continue to be a major influence on markets going forward. Here’s what you need to know about inflation, what the Fed is doing about it, and how it impacts you and your money.

The Federal Reserve, interest rates, and inflation

The Fed’s job is to keep both unemployment and inflation low. To accomplish this, the Fed has one main tool at their disposal: interest rates. In general and in the simplest form, they use this tool to prevent the economy from becoming too hot or too cold.

When they lower interest rates (or “loosen” policy), they make borrowing cheaper and help fuel economic activity. That’s what they were trying to do when they cut rates to zero in 2020 at the beginning of the pandemic recession. When the economy is in overdrive or inflation becomes a concern, they will do the opposite, raise rates (or “tighten” policy).

How exactly do rate hikes impact the economy and how might they reduce inflation? Inflation occurs when demand is outpacing supply. The Fed moving around interest rates doesn't have any impact on supply but can have a very powerful effect on demand. This means the Fed’s only way to control inflation is to bring down demand from both consumers and businesses by making it more expensive to borrow money.

Since companies often borrow money for capital projects (like building a new facility or acquiring new equipment), increased borrowing costs will probably slow down that activity and help dampen inflation.

How did inflation get so high in the first place?

The most recent Consumer Price Index report indicated that prices rose 8.5% over the last year, which is the greatest annual increase since 1982. How did we get here?

We can think of inflation as the result of demand outpacing supply, or when people have both the ability and desire to buy more stuff than the economy can produce and deliver. Over the course of this pandemic recovery, all four of those words were critical to how inflation got so high: ability, desire, produce and deliver.

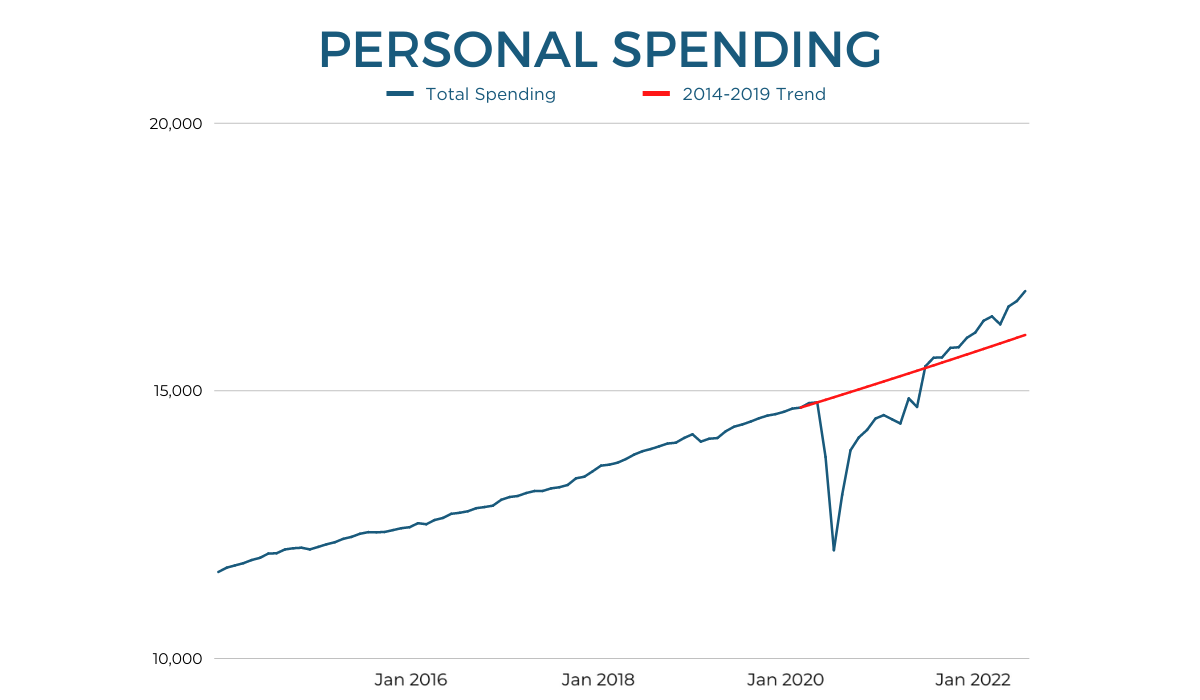

Initially it was stimulus payments from the federal government that created the ability for people to spend more. Even after the stimulus came and went, the labor market remained extremely strong, which allowed wage gains to pick up where stimulus left off. As the economy started to reopen in 2021, the desire to spend really ramped up. Some of this was pent-up demand for things like travel. But also spending on goods remains quite elevated. As of March 2022, consumer spending on goods is 29% above 2019 levels.

There were also some challenges in the supply chain due to events like factory shutdowns. This was especially impactful in the auto industry. Plus there have been persistent challenges with labor shortages across all aspects of the U.S. economy, from factory workers to truck drivers to warehouse workers. Combine this with unusually strong demand, especially for physical goods, and the economy is struggling to either produce and/or deliver the goods people want to buy.

When companies see strong demand for their product, normally they choose to sell more and increase profits that way. But when they can’t realistically produce more, they raise prices instead. This seems to be exactly the situation we are in today.

Why is the Fed behind the curve?

It is a fair question to ask why the Fed has waited until only just now to get aggressive about fighting inflation. To cut the Fed a little slack, let’s remember what a strange economic cycle this has been. The immediate onset of the pandemic caused unemployment to surge to Great Depression levels in the spring of 2020. Both Congress and the Fed tried using all the tools they had to combat this slowdown, with the Fed cutting rates and the government cutting stimulus checks.

When inflation first started to pick up in the spring of 2021, it was easy to dismiss it as stemming from temporary factors. Inflation was being driven by a pretty narrow set of items, all of which appeared to be mostly pandemic related. For example, airline tickets, hotel rooms and rental cars were three of the biggest price drivers. That seemed to be a function of pent-up demand for travel and leisure. People were spending those March 2021 stimulus checks on a June vacation. Surely that effect would come and go though, right?

What the Fed didn’t bet on was just how strong the labor market was. Although the Fed figured the fading effects of stimulus would cause household incomes to decline, rising wages actually allowed consumer spending to remain well above pre-pandemic levels with no obvious sign of abating.

So at one time it wasn’t illogical for the Fed to assume the inflation problem would solve itself. However, now we can see that it will be a tough problem to solve. Inflation will probably remain high as long as consumer spending remains this high. Consumer spending will remain elevated as long as household income continues to grow at this pace. Household income is primarily fueled by wage growth, and wage growth will remain strong as long as the labor market is this tight.

For context, the last time inflation was as high as it is now was in the 1970’s which was a very different market. At that time, the U.S. stock market was dominated by heavy manufacturing, commodities producers and utilities. The way inflation impacts those kinds of firms is very different from how it impacts today’s giants like Apple and Amazon. Additionally, while the Fed is currently behind the curve, it has already been far more proactive this time around. In the 1970’s, inflation had been running high for nearly a decade before the Fed got serious about fighting it.

What do higher interest rates mean for you and your money?

There are a number of ways that higher interest rates may ultimately impact you and your money. Most notably, higher interest rates can affect how you save for short-term goals, your ability to make major purchases, and your long-term investing strategy.

Savings for short-term goals: Higher interest rates means that the interest rate you earn on your savings accounts should be going up. If you are saving up cash for a short-term goal (in the next two or three years), you should leverage savings accounts with the best rates (like high yield savings accounts) and possibly consider I bonds for goals that are 12 months or more away.

Ability to make major purchases: Buying a home or a car or taking out private loans to pay for college gets more expensive as interest rates go up because the cost of borrowing is higher. On the flip side, rising rates should (emphasis on should) cool off the blistering rise in real estate and car prices. When it comes to buying a home or a car, look to save a little extra for a down payment. The more you can put down upfront, the smaller your loan and the lower your interest costs. Second, reassessing your target purchase price could be helpful.

Long-term investing strategy: In general, your approach to investing may not need to change. Market volatility is a normal part of investing but heightened volatility is likely here to stay (see market context below). There is no risk-free, high-return investment but if certain levels of persistent volatility are unsettling for your situation, you can make adjustments to the level of risk in your portfolio.

There is a good chance that the impact of inflation itself has already been felt in financial markets. Remember that markets are forward looking, meaning the price of a stock or bond incorporates what everyone expects will happen in the future. Since people already know and acknowledge that inflation is high, that knowledge is priced into the markets to a certain degree.

So why is volatility likely here to stay? In part, this is because of the risk that the Fed may hike interest rates too high, too fast and bring about a recession. It may be tempting to try to jump out of stocks in hopes that you avoid further pain should a recession actually occur but the problem is that guessing when a recession is coming is extremely hard, and the consequences for being wrong can be substantial. There are lots of recession head-fakes during an economic expansion. During the post 2008 expansion there were at least three such head-fakes: 2011, 2016 and 2018. In all cases, stocks experienced a brief but sharp downturn only to roar back once it became clear the economy was still on strong footing.

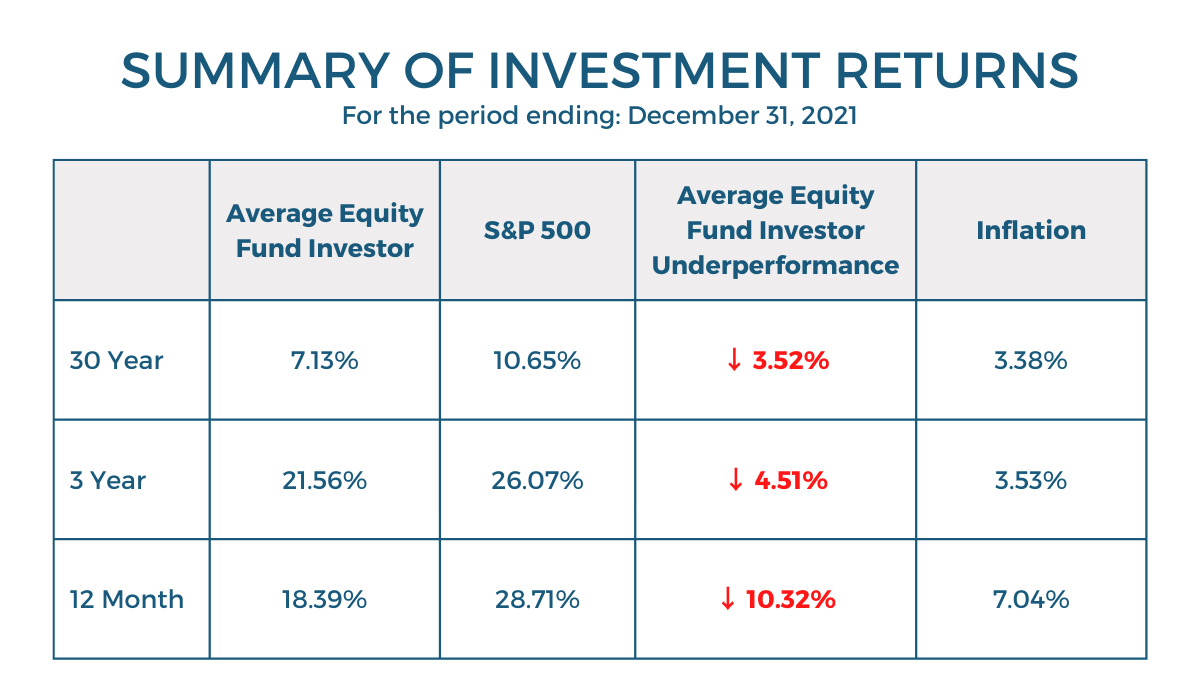

We can see just how damaging market timing can be by looking at how the average investor performed relative to the S&P 500 over various time periods. You can think of this as comparing the returns of someone who tries to time market entries and exits vs. someone who sticks with their plan and stays invested:

*Source: DALBAR Quantitative Analysis of Investor Behavior Research

To drive this point home, if you started with $10,000 and got the same 7.13% return as the “average equity fund investor” above, you would have ended up with $78,947 over 30 years. Had you chosen to stay invested instead, your return would’ve been 10.65% and you would have ended up with $208,230.

The message is quite clear. How we behave matters far more than how interest rates, inflation, or the markets behave and having a disciplined approach to investing, especially during periods of volatility or market corrections, is the right approach. The key to better long-term investment outcomes is to focus on what we can control and to discount the things we cannot. While we cannot control the level of inflation or how quickly the Fed raises rates or what happens to markets as a result, we can control key financial decisions that put us in control of the kind of life we want to live. For example, we can control how much we invest, the fees we pay, how we manage taxes, how we manage and control risk, and how we evolve our strategy over time as life and our goals change.

A CFP® Professional at Facet can help you navigate the impact of inflation and higher interest rates on your money and develop a dynamic financial strategy that evolves as life, and the world around it, changes.